What is an offset mortgage and what are its benefits?

Issued 07.12.2022

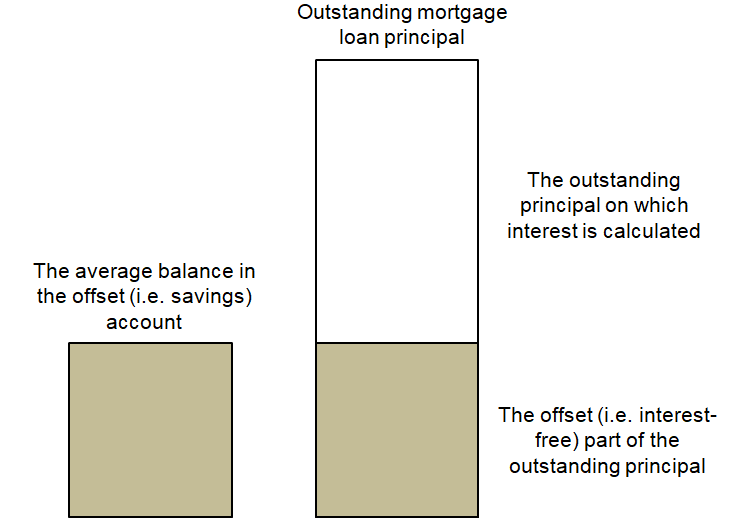

The principle of an offset mortgage consists in offsetting the account balance against the amount owed. The client thus pays interest only on the difference between the unpaid loan principal and the amount on the offset account. The balance on the offset account can change continuously, and the amount of interest paid changes according to the change in the balance. The principal is still amortized the same, but the interest changes according to the current balance in the offset account.

It is a mortgage loan that is combined with an offset (savings) account. This type of loan is sufficient for clients who have, or will soon have, a sufficient amount of deposits that can be deposited into an offset account. There are no interests earned on the offset savings account. In the case of this type of mortgage, it is possible for the client to actively influence the amount of interest paid on the mortgage by making deposits into a savings account. Thanks to this principle, the installment paid is lower than it would be in the case of a classic mortgage.

An example can be a mortgage loan in the total amount of CZK 10,000,000 with a maturity of 30 years and an interest rate of 5.79% p.a. For a regular mortgage loan, the monthly installment would amount to CZK 58,673. However, if the client uses the offset mortgage option and deposits CZK 4,000,000 into the offset (savings) account, he/she will only pay interest on the amount of CZK 6,000,000. In this case, the monthly installment of the offset mortgage would be CZK 46,317.

Money deposited in the savings account is accessible at any time and can be used for the purchase of another property or the implementation of a business project. It is possible to deposit an amount up to 100% of the loan amount into an offset (savings account), in which case the client would not pay any interest on the mortgage loan.